loveland co sales tax registration

The amount due is a percentage of the purchase price and is based on the taxing jurisdiction of the buyer and seller. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales Property.

Renew Your Sales Tax License Department Of Revenue Taxation

If you live outside of Larimer county or need to calculate sales tax rates for other purchases besides motor vehicles this tool may not provide the correct information.

. The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. 5400 Stone Creek Circle Loveland CO 80538. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

Calculate sales tax. Welcome to Sales Tax. 80537 80538 and 80539.

110 Loveland CO 80537 Phone. 2022 Cost of Living Calculator for Taxes. 500 East Third St STE 110.

500 East Third Street Ste. Register as a new User Apply for a Sales Tax License Renew your License or File your Return Citizen Access Login. An alternative sales tax rate of 77 applies in the tax region Berthoud which appertains to zip code 80537.

Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Loveland Colorado Tax Registration. Real property tax on median home. This tool is designed for calculating the sales tax rates for residents of Larimer County who purchased a motor vehicle on or after January 1st 2019.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Sales tax laws See which nexus laws are in place for each state SALES TAX RATES. Sometimes taxpayers refer to this as a business registration but it is an application for a Colorado sales tax account or sales tax license.

An alternative sales tax rate of 765 applies in the tax region Windsor which appertains to zip code 80538. DR 0155 - Sales Tax Return for Unpaid Tax from the Sale of a Business. DR 0154 - Sales Tax Return for Occasional Sales.

DR 0235 - Request for Vending Machine Decals. Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales Property and Registration Taxes and an Online Tool to customize your own personal estimated tax burden. Loveland Colorado and Colorado Springs Colorado.

Sales Tax State Local Sales Tax on Food. Address City of Loveland 500 E. 3Link to Business NEW BUSINESS.

This is the total of state county and city sales tax rates. The Loveland sales tax rate is. The Loveland Colorado sales tax rate of 67 applies to the following three zip codes.

Identify the licenses permits and how many you need to start or grow your business in Loveland. Real property tax on median home. Download our Colorado sales tax database.

Because of the different cities and taxing jurisdictions within Larimer county the sales tax rates will vary. Most Colorado sales tax license types are valid for a two-year period and expire at the end of each odd-numbered year. Before you apply for a sales tax license or submit your first payment please contact your bank and provide them with the City of Lovelands ACH DebitAccess ID 8846000609 to ensure your payment will not be rejected.

2022 Cost of Living Calculator for Taxes. The County sales tax rate is. Sales Tax State Local Sales Tax on Food.

Sales Tax License Application. In Colorado services are not subject to sales tax. The Colorado sales tax rate is currently.

Adams To Pick Up an Application Loveland CO 80527 Get Directions. Business Support Resources. Scroll to the bottom of the Business Profile page 2Create a User Profile SELECT ENTER CONNECT For Assistance Contact MUNIRevs Support.

Loveland Colorado business licenses. In general tangible personal property is subject to sales and use taxes. DR 0100 - 2022 Retail Sales Tax Return Supplemental Instructions DR 0103 - 2022 State Service Fee Worksheet.

Click on the link below to. Address House of Neighborly Service - The Life Center 1511 E. 11th Street Ste 100 Loveland CO 80537 Get Directions.

The Loveland Business Development Center LBDC offers no-cost confidential consulting services business workshops and networking opportunities for aspiring entrepreneurs and existing businesses. The average sales tax rate in Colorado is 6078. Sales taxes are due one time after a new or used vehicle purchase at the time your vehicle is titled.

A Loveland Colorado Tax Registration can only be obtained through an authorized government agency. CR 0100AP - Business Application for Sales Tax Account. We recommend that you obtain a Business License Compliance Package BLCP.

The minimum combined 2022 sales tax rate for Loveland Colorado is. Address Loveland Public Library 300 N. Third Street Utility Billing Front Cashier Loveland CO 80537 Get Directions.

The logic behind a Use Tax is that the materials being used on Loveland construction sites was being purchased outside the city. In all likelihood the Colorado Sales Tax Withholding Account Application - CR 0100 AP is not the only document you should review as you seek business license compliance in Loveland CO. Method to calculate Loveland sales tax in 2021.

The construction of new buildings or homes within the City of Loveland. Loveland Colorado and Fort Collins Colorado. The Loveland Use Tax was created in the late 1990s and imposes a 3 fee on all materials used in.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

New Used Rvs Motorhomes Travel Trailers For Sale Lazydays Diesel Motorhomes For Sale Motorhomes For Sale Used Rvs

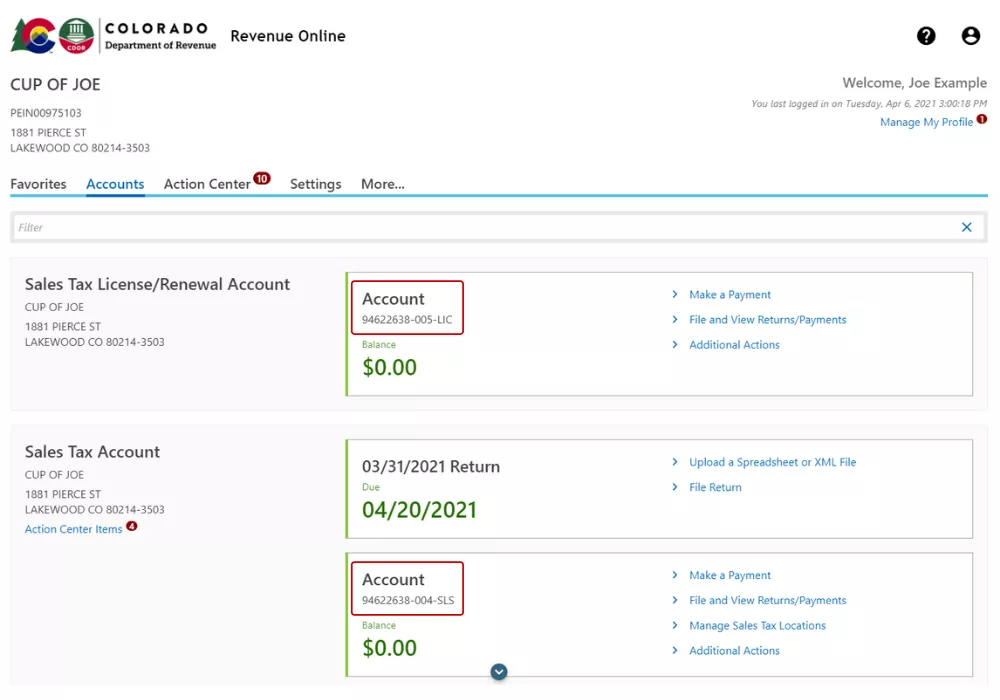

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Register New Businesses In Colorado Colorado Business Express Business State Of Colorado Colorado

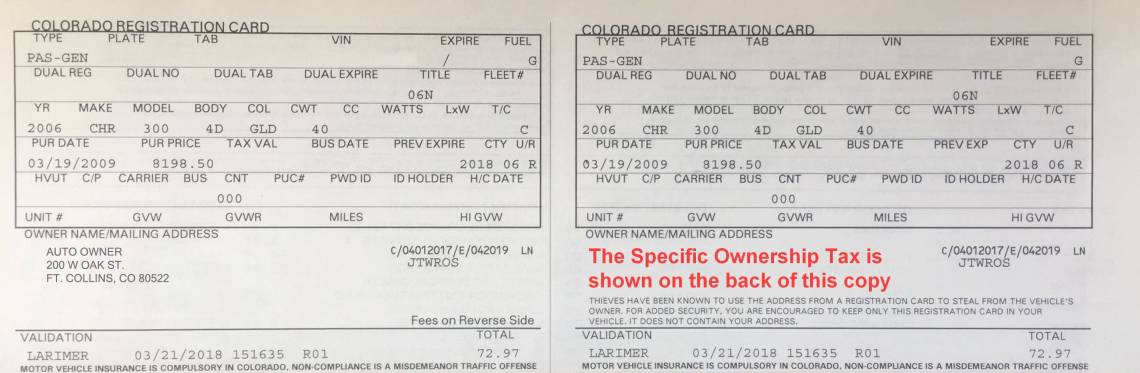

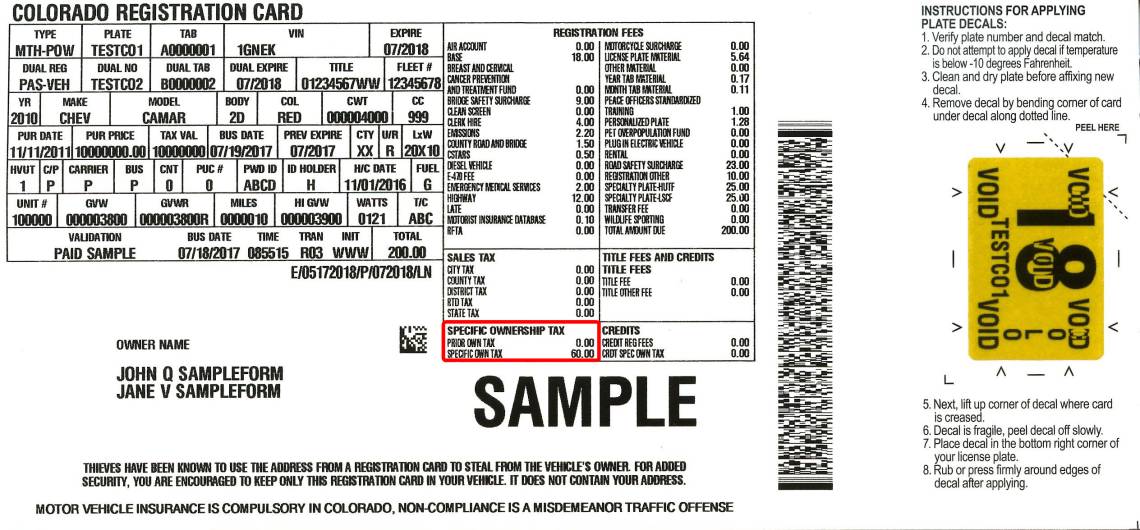

Colorado Car Registration A Helpful Illustrative Guide

Renaldi Connolly Jacquard Lagune Home Goods Decor My Home Design Home Decor Fabric

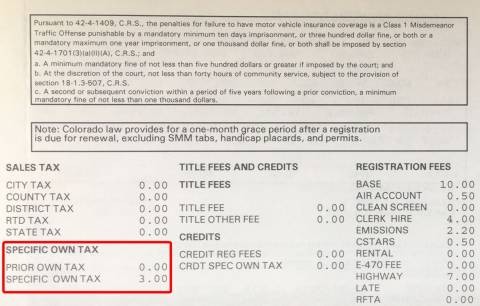

Specific Ownership Tax Larimer County

Specific Ownership Tax Larimer County

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Specific Ownership Tax Larimer County

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation